Facing Any of These Concerns?

Lack of Support from Firm/Manager

Case Submission is Manual and Tedious

Limited Financial Solutions For Clients

Rely on Traditional Marketing for Lead Generation

Lack of proper training and coaching by Firm/Manager

No Product Comparison Support

Zero-Breakthrough in business

“Putting clients’ interest first” is why we have thrived for the past 20 years.

But that is not all….

In Financial Alliance, we always strive to provide more support and tools to ensure our consultants provide the smoothest services to our clients.

Join us and be part of the

#PeopleFirstJourney

Key Offers to Excel in Your Career

What Do We Offer?

Tools and Support for Lead Generation

Engage is an in-house marketing portal for all of our consultants to build their online presence without the need to engage with web-designers and vendors.

Consultants can easily share their articles, services, events and instant quotation to their clients instantly.

ENGAGE

Your Personal Marketing Portal

Financial literacy is a core life skill, a skill consumers need to be able to make sound financial decisions and achieve financial well-being. Through Nudge Webinar, you can invite your client and prospect to boost their financial literacy and financial capability.

Our speakers comprise inhouse experts and financial practitioners. Leverage on Nudge Webinar to provide extra points of contact with your client and prospect to nurture a better relationship.

NUDGE Webinar

Events for Your Clients

Besides providing our Financial Consultants with the tools needed to build their online presence, we also provide various digital marketing training and workshops for our consultants to adapt and learn the latest trend in the digital marketing space, including social media management and social media advertisement campaigns.

Our Financial Consultants can also reach out to our in-house digital marketing team, who is ever ready in facilitating them on their digital marketing efforts to help beef up their online content.

ELEVATE Training Series

In-house Digital Marketing Training

(Click on Logo to Learn More)

What Do We Offer?

Training and Development Program

Comprehensive training and continual development program for new joiners

New Joiners:

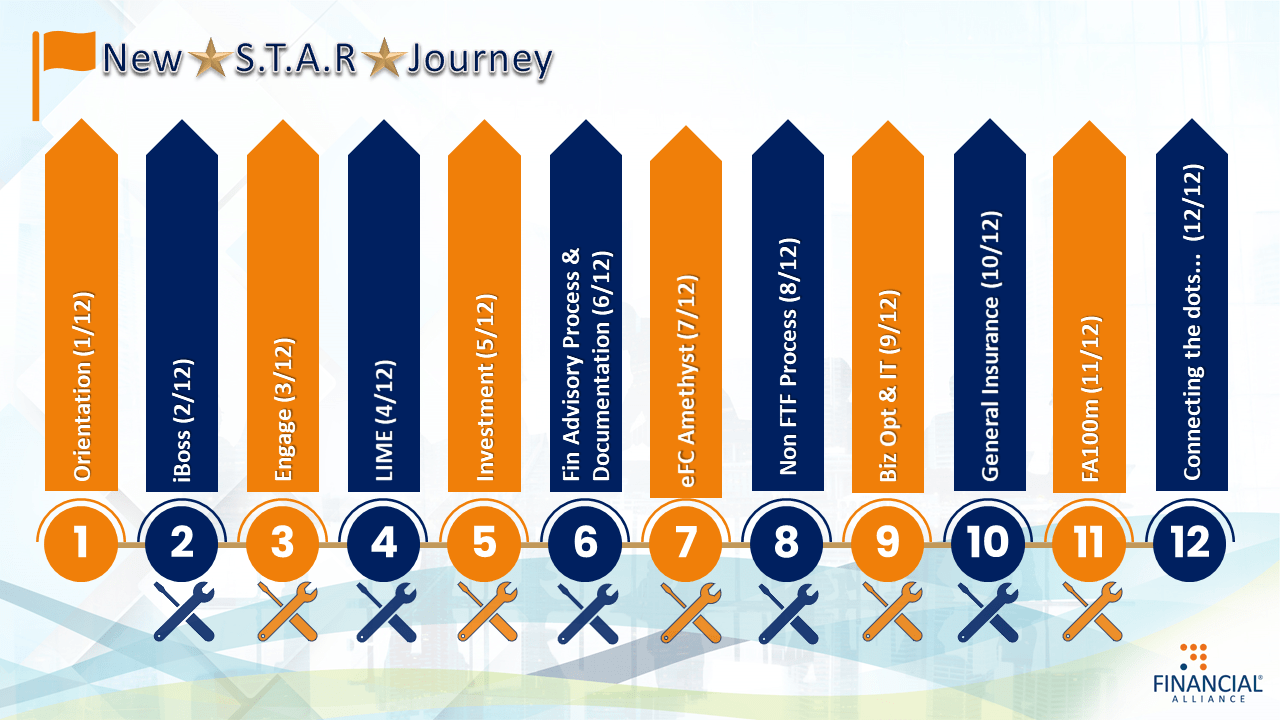

New Star Journey

New Star Journey consists of 12 specially curated modules to give new consultants a comprehensive overview and to equip them on the use of FAPL’s ACSIS eco-systems.

BMQ

BMQ, or Breakthrough Miracle Quarter, is a 90-day intensive training for new consultants

Further Learning:

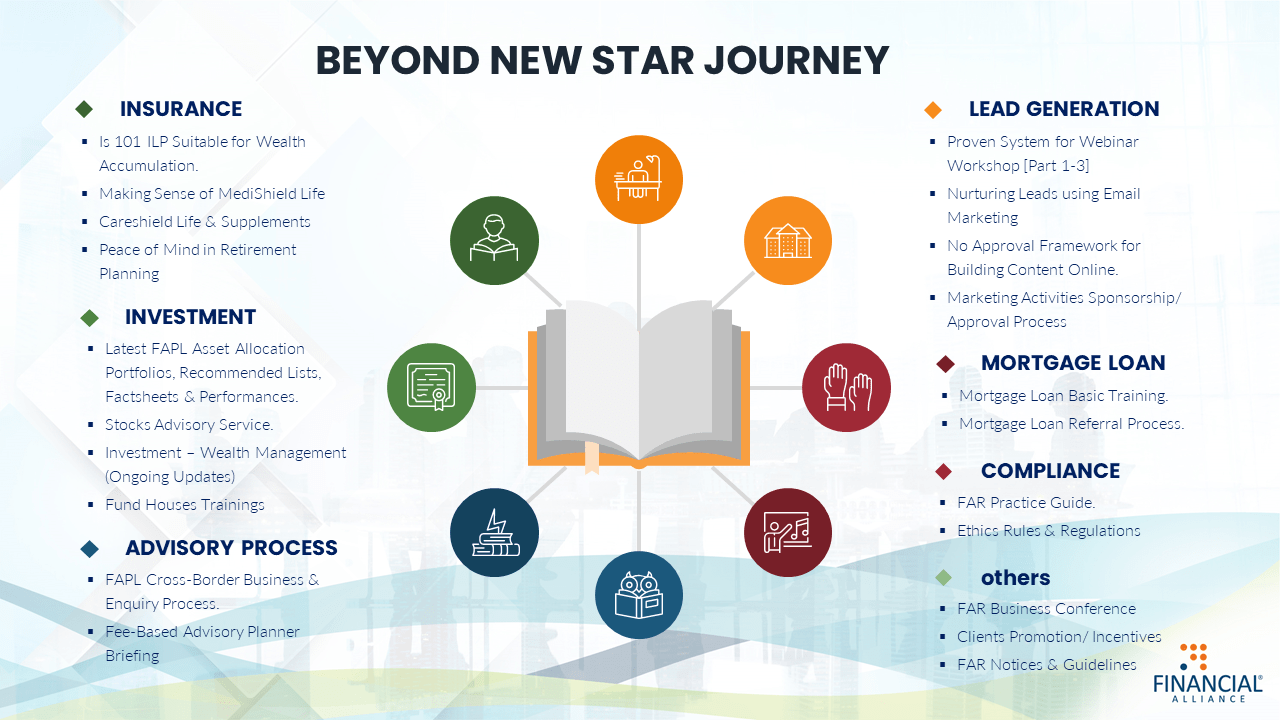

Beyond New Star Journey

Beyond New Star Journey is an extension of the New Star Journey. It includes 7 additional modules on industry knowledge and helps consultants to accelerate their learning curve.

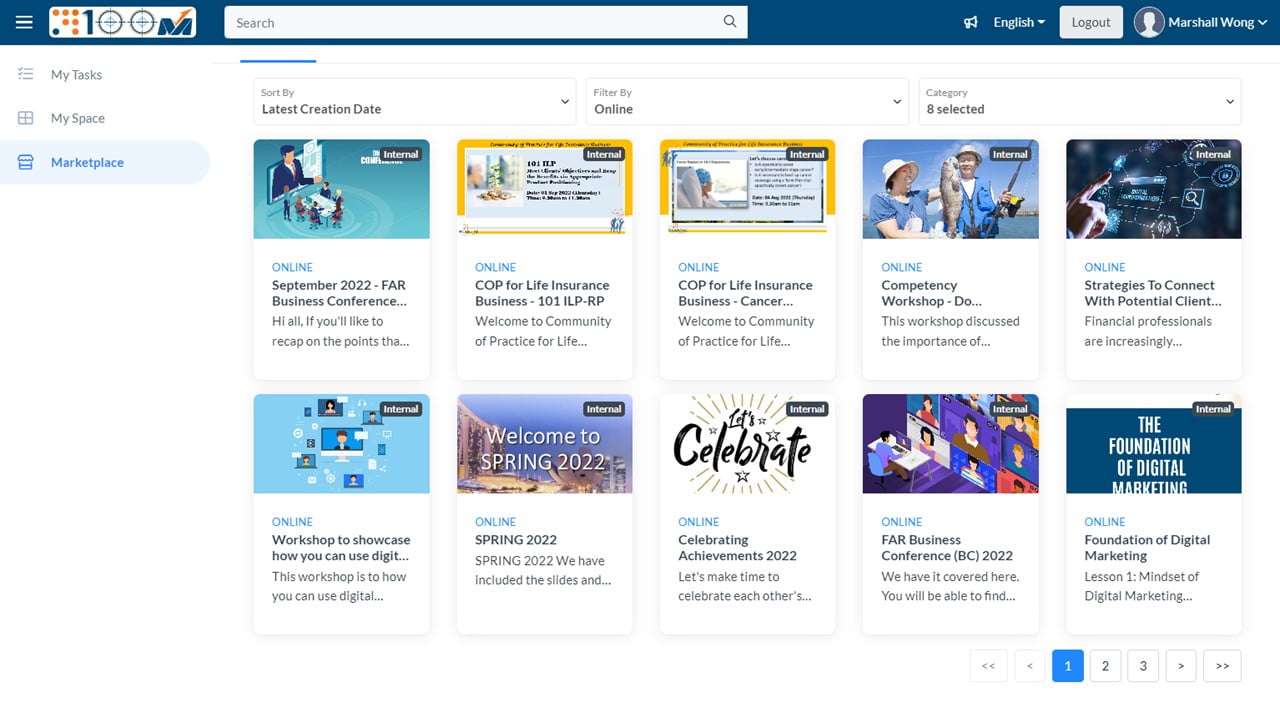

FA100M

FA100M is an in-house e-Learning Portal with hundreds of structured training modules to enhance your industry knowledge.

For Excellence:

Community of Practice

Within Financial Alliance, we have communities of practice in which we discuss and share tips about Life Insurance, Investment and achieving MDRT.

What Do We Offer?

ACSIS

Digital Consultant Eco-system

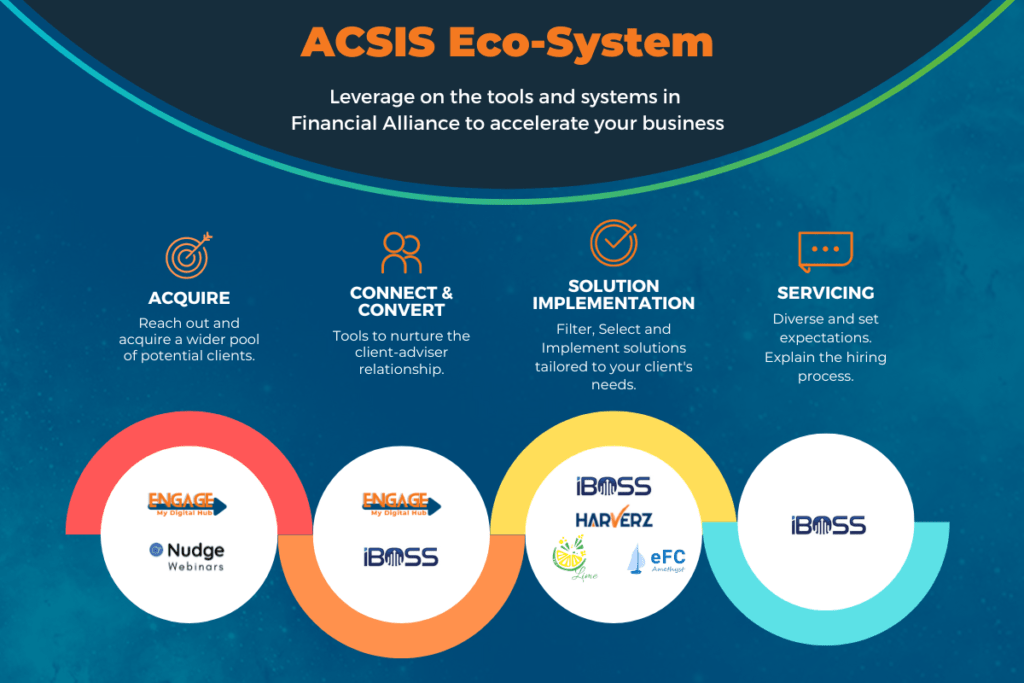

At Financial Alliance, we empower you as a Financial Consultant and elevate your capabilities to thrive in the digital world with the Acquire, Connect & Convert, Solution Implementation, and Servicing (ACSIS) Eco-system.

ACSIS digital eco-system is a consolidation and integration of our current proprietary systems that helps raise our Financial Consultants’ productivity and careers to new peaks!

Explore our systems and support:

Through ENGAGE, our consultants can easily build their business process and enable leads to find their profile online via Google Search Engine or via other social media platforms.

“NUDGE WEBINAR” is a weekly webinar series that provides an opportunity for consultants to invite their clients and prospects to our company-hosted events.

They are educational webinars with “Calls To Action” that create additional touch points for consultants and their clients/prospects.

IBOSS CRM is a client relationship management platform that helps consultants organise and store their clients’ information systematically.

It allows consultants to keep in touch with clients on a regular basis, be it season’s greetings, new product updates or invitations to our events/webinars.

Harverz provides consultants with a bird’s eye view of all investment solutions that are available in the financial market so that the consultants can choose the most suitable investment products to fit into portfolios that suit their clients’ goals, profiles and objectives to achieve their desired returns.

With LIME (Life Insurance Made Easy), consultants of Financial Alliance do not have to spend hours and hours to comb through the various Life Insurance products offered by various Insurance firms to source for the ideal plan for their clients.

eFC Amethyst is an all-in-one toolkit that enables our financial consultants to conduct business anywhere, anytime.

It allows our consultants to guide their clients through the financial advisory planning process in a comprehensive and easy-to-understand manner, from identifying their clients' needs and financial analysis to the recommendation of suitable solutions to the clients.

It documents the advisory process and serves as a record for future reference.

(Click on Logo to Learn More)

What Do We Offer?

Comprehensive Solutions Platform

With the most financial products and solution offerings in the FA industry

Having the widest range of financial and wealth accumulation products separates you from the rest and allows you to provide the necessary solutions tailored to your clients’ needs.

- AIA Singapore Pte Ltd

- AXA Insurance Pte Ltd

- China Life Insurance (S'pore) Pte Ltd

- China Taiping Insurance (S'pore) Pte Ltd

- Etiqa Insurance Pte Ltd

- Friends Provident International (S'pore Branch)

- FWD Singapore Pte Ltd

- HSBC Insurance (S'pore) Pte Ltd

- Income Insurance Limited

- Life Insurance Corporation (Singapore) Pte Ltd

- Manulife (Singapore) Pte Ltd

- Raffles Health Insurance Pte Ltd

- Singapore Life Ltd

- Sun Life Assurance Company of Canada (S'pore Branch)

- Swiss Life (S'pore) Pte Ltd

- Tokio Marine Life Insurance S'pore Ltd

- Transamerica Life (Bermuda) Ltd

- Utmost Worldwide Limited (S'pore Branch)

Life Insurance Companies

- Aetna Insurance (Singapore) Pte Ltd.

- AIG Asia Pacific Insurance Pte Ltd

- Allianz Global Corporate & Specialty (AGCS)

- Allianz Insurance Singapore Pte Ltd

- Allied World Assurance Company, Ltd (Singapore)

- AIA Singapore Pte Ltd

- AXA Insurance Pte Ltd

- Berkshire Hathaway Specialty Insurance Company

- China Taiping Insurance (Singapore) Pte Ltd

- Chubb Insurance Singapore Limited

- CIGNA International

- Delta Underwriting Pte Ltd

- Direct Asia Insurance (Singapore) Pte Ltd

- ECICS Limited

- EQ Insurance Company Ltd

- ERGO Insurance Pte Ltd

- Etiqa Insurance Pte Ltd

- Great American Insurance Company

- Great Eastern Life Assurance Co. Ltd

- Great Eastern General Insurance Limited

- HL Assurance Pte Ltd

- Income Insurance Limited

- India International Insurance Pte Ltd

- Liberty Insurance Pte Ltd

- Lonpac Insurance Bhd

- MS First Capital Insurance Ltd

- MSIG Insurance (S'pore) Pte Ltd

- QBE Insurance (International) Ltd

- Raffles Health Insurance Pte Ltd

- Singapore Life Ltd

- Sompo Insurance Singapore Pte Ltd

- Tokio Marine Insurance Singapore Ltd

- Tokio Marine Life Singapore Ltd

- United Overseas Insurance Ltd

- XL Insurance Company SE Singapore Branch

- Zurich Insurance Co Limited

General Insurance Companies

- ADDX Pte Ltd

- Bank of Singapore Ltd

- Havenport Investments Pte. Ltd.

- iFAST Financial

- Maybank Singapore Limited

- Navigator Investment Services Ltd

- Phillip Securities Pte Ltd

- Swiss-Asia Financial Services Pte Ltd

- Tiger Brokers (Singapore) Pte Ltd

- UBS Securities Pte Ltd

- UOB Kay Hian

Investment Platforms

- Abrdn Asia Limited

- AllianceBernstein (Singapore) Ltd

- Allianz Global Investors Singapore Ltd

- Alquity Investment Management Limited

- Amundi Singapore Limited

- AR Capital Pte Ltd

- Arabesque Asset Management

- Aviva Investors Asia Pte Ltd

- AXA Investment Managers Asia (Singapore) Ltd

- BIMB Investment Management Bhd

- BlackRock (Singapore) Limited

- BNP Paribas Asset Management - BNPP Funds & Paribas A

- BNY Mellon Investment Management Singapore Pte Limited

- Canaccord Genuity Wealth (International) Limited

- Columbia Threadneedle Investments (Lux)

- Credit Suisse Fund Services (Luxembourg) S.A.

- Dimensional Fund Advisors Ltd

- Duxton Asset Management Pte Ltd

- DWS Investments S.A.

- Eastspring Investments (Singapore) Limited

- EFG Asset Management

- Eurizon Capital S.A.

- Fidelity International

- First Degree Global Asset Management Pte Ltd

- First Sentier Investors (Singapore)

- Franklin Templeton Investments

- Fullerton Fund Management Company Ltd

- Fundsmith LLP SICAV

- Goldman Sachs Asset Management Fund Services Limited

- HSBC Global Asset Management (Singapore) Limited

- iFAST Fund Management

- Invesco Asset Management Asia Limited

- J.P. Morgan Asset Management

- Janus Henderson Investors - Capital Funds SICAV

- Jupiter Asset Management (Asia) Pte Ltd

- Kotak Mahindra (UK) Limited

- Legg Mason Asset Management Singapore Pte Ltd

- Lion Global Investors Limited

- Man Investments Limited

- Manulife Asset Management (Singapore) Pte Ltd

- Matthews Asia Funds

- Maybank Asset Management Singapore Pte Ltd

- Mirae Asset Global Investments (Hong Kong) Ltd

- Momentum Global Investment Management

- Natixis Investment Managers (Natixis IF Luxembourg)

- Neuberger Berman - Retail Funds

- Nikko Asset Management Asia Limited

- NN Investment Partners

- PC Asset Management Limited (FundBPO HK Ltd)

- PIMCO Funds: Global Investors Series plc

- Phillip Capital Management

- PineBridge Investments Singapore Limited

- Pilgrim Partners Asia (Pte) Ltd

- Portal Asset Management Pte Ltd

- Prime Asia Asset Management Pte Ltd

- Principal Asset Management (S) Pte Ltd

- Principal Islamic Asset Management Sdn Bhd

- RHB Asset Management Pte Ltd - Retail Funds

- Robeco

- Schroder Investment Management

- Superfund Financial (Hong Kong) Ltd

- Swaen Capital Pte Ltd

- Swiss Asia Holdings Pte Ltd

- UBS Asset Management (Singapore) Ltd

- UOB Asset Management

- UTI International (Singapore) Pte Ltd

- Value Partners Asset Management Singapore Pte Ltd

- Vanguard Investments Singapore Pte Ltd

- Wells Fargo Funds Management LLC

- Zeal Asset Management Limited

Asset Management Companies

- Bank of China Singapore Branch

- CIMB Bank Singapore

- Citibank Singapore

- DBS Bank Ltd

- Hong Leong Finance

- HSBC Singapore

- Maybank Singapore

- OCBC Bank Singapore

- POSB Bank

- RHB Singapore

- State Bank of India Singapore

- Sing Investments & Finance Ltd

- Singapura Finance Ltd

- Standard Chartered Singapore

- UOB Bank Ltd

- Westpac Banking Corporation

Bank Loan Partners

- Absolute Trust & Estate Pte Ltd

- Barakah Capital Planners Pte Ltd

- Characterist LLP

- Chris Chong & CT Ho LLP

- Falco Heritage Pte Ltd

- Kensington Trust Group

- Metis Global (Singapore) Pte Ltd

- Precepts Legacy Pte Ltd

- Vistra Trust (Singapore) Pte Limited

Estate Planning Partners

(Click on the numbers to learn more)

What Do We Offer?

Exceptional Support System

Get support from us for all your client-serving needs

Life insurance advisory support aims to help consultants become more productive.

- Information relevant to the life insurance business, including all product information, is organized and housed under an internal portal for easy reference.

- Product analysis & comparison reports are available to help consultants find suitable and viable products that meet clients' needs.

Insurance Advisory Support

We are well supported by a team of Investment veterans and specialists who provide a wide suite of investment solutions, including managed accounts and alternative investments (some are exclusive to our company).

To enable consultants to keep abreast of financial market developments, the team provides regular updates of the market situation.

In addition to that, we constantly engage our clients via investment updates and education seminars.

Investment Advisory Support

Our General Insurance Department is here to make it easier for you to transact & manage your General & Group Insurance business.

We render the following supports:

- Comprehensive Administrative Support

- Bridge between GI Business Partners and Financial Consultants

- Attend to Consultants’ enquiries pertaining general product information, underwriting requirements, process flow and system

General Insurance Support

FAR Development exists to facilitate growth through these key differentiators:

- BMQ- peers learning, from practitioners to practitioners

• Communities of Practice – translate Learning to LEarning

• FA100M – e-learning on demand, contents by choice, anytime anywhere

• Momentum Dashboard – consultant-centric progress reporting

• Monthly FAR Conference - celebration of achievements

Our process enables us to constantly eliminate & reduce pain points and raise & create value points to bring about deeper engagement with our consultants, journeying together with them to meet their goals and aspirations.

FAR Development Support

The Business Development Team strives to be on the forefront when it comes to supporting our Financial Consultants in Lead Generation Strategies.

With that in mind, we launched ENGAGE, a digital hub for consultants to build their online presence.

Besides ENGAGE, our Weekly Elevate Webinar Series has helped to boost our clients’ financial literacy. They also provide additional touch points between Consultants and Prospects/Clients. At the end of each webinar, there is a Call To Action where Consultants will follow up with their invited guests for discussions and meetings, which lead to more business opportunities.

Business Development Support

(Click on the icon to learn more)

Financial Alliance renders even more support.

Click on the button below to find out more

What Do We Offer?

Career Growth Opportunity

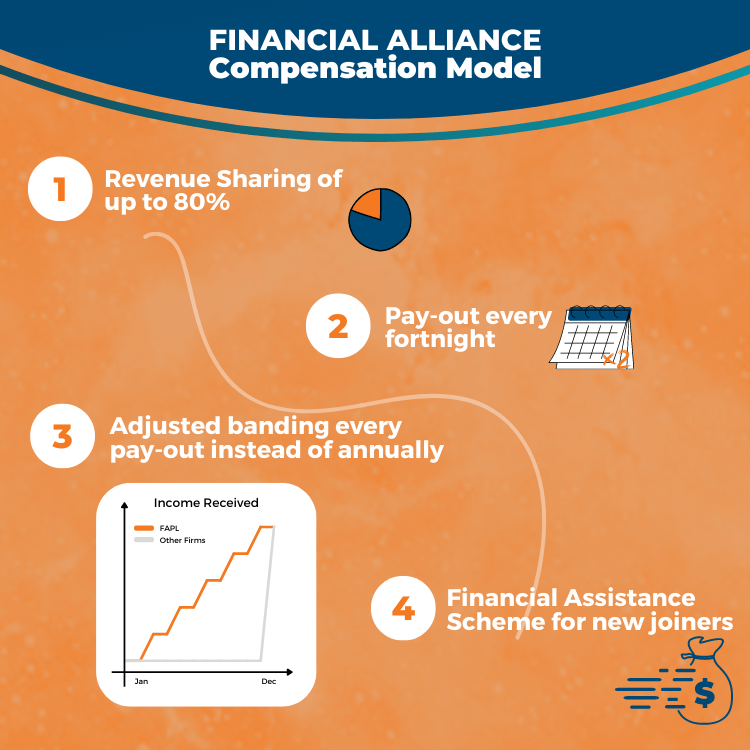

Unique compensation model and progressive career path

What Do We Offer?

Unique Positioning

As the Largest IFA in Singapore

According to Monetary Authority of Singapore’s (“MAS”) strict guidelines, FA firms can only use the term “independent” to describe itself and its services if:

It does not receive any commission or other benefit from a product provider which may create product bias and does not pay any commission to or confer other benefits upon its representatives which may create product bias.

It operates free from any direct or indirect restriction relating to any investment product which is recommended.

It operates without any conflict of interest created by any connection or association with any product provider.

Hear from Our Consultants

Consultant's Sharing

5:52

4:01

3:36

6:17

3:58

Ready to Accelerate Your Career Progression?

Join Financial Alliance, Choose Quality, and take your career to new heights!