Give Yourself an Unfair Advantage

in Your Investment Advisory Business

The Right Tools & Support Matters

Date: 20 November 2025 (Thursday)

Time: 7:00 PM – 9:00 PM

(Light refreshment will be served from 6:00pm)

Venue: Financial Alliance, Level 12, Gateway West

Event Programme

Time | Activity |

|---|---|

6.00 pm | Registration & Networking (Refreshment provided) |

7.00 pm | Welcome Address |

7.05 pm | Fireside Chat: Uncovering the Unfair Advantage in FAPL Featuring Sani Hamid, Director, Wealth Management (Economy & Market Strategy) |

7.50 pm | Consultant Spotlight: From Engineer to Investment Advisor Featuring Kenny Loh, Wealth Advisory Director, Financial Alliance |

8.30 pm | Networking & Breakout Sessions |

9.00 pm | Event Concludes |

unfair

advantage

Why Attend

This is not another generic recruitment talk.

It’s an inside look at how Financial Alliance empowers consultants to grow sustainable, fee-based investment advisory businesses — with real stories, proven systems, and practical tips you can apply immediately.

Whether you’re an experienced consultant or considering a mid-career switch, this session will show you how the Right Support can help you build the future you want.

Part #1: Fireside Chat - Uncovering the Unfair Advantage in FAPL

Sani Hamid

Director

Wealth Management

(Economy & Market Strategy)

The Right Support to Power Your Success

Behind every successful consultant is a strong support ecosystem.

At Financial Alliance, we’ve built ours to give you an unfair advantage.

What You’ll Learn:

Dedicated In-House Investment Team — Full-time specialists like Sani and Victor Wong who cut through market noise and provide actionable insights.

Harverz: Our proprietary platform that gives consultants a bird’s-eye view of 10 investment platforms and partnerships with multiple fund houses — so you can craft tailor-made portfolios that truly fit your clients’ goals.

Unrivalled Range of Solutions — From Shariah-compliant portfolios to global tax and estate planning strategies, you’ll have the freedom to advise clients locally and internationally.

Open Architecture Advantage — Collaborate across fund houses, product providers, and platforms to deliver holistic financial advice with no restrictions.

“We remove the limits — so our consultants can focus on what matters: results, relationships, and recurring income.”

Part #2: Consultant Spotlight - From Engineer to Investment Advisor

Kenny Loh

Wealth Advisory Director

Real Stories, Real Growth

When Kenny Loh left engineering to pursue financial advisory, he asked himself what every mid-career professional wonders:

Is it really possible to make a living doing AUA business? Is it too late to start?

Now, Kenny’s answer is a resounding yes.

He rebuilt his income by focusing on Investment, turning market volatility into client trust and building long-term, recurring revenue.

What You’ll Learn:

Why building AUA creates recurring, transferable income that grows with your clients – and even beyond generations.

How to get clients started on the AUA journey, from personal networks to digital presence.

How to manage client expectations and emotions during volatile markets.

The steps Kenny took:

Build skill set

Build credibility

Find leads

The power of FA’s sharing culture — where collaboration accelerates learning and growth.

Building client wealth through INVESTMENT is the cornerstone of holistic financial planning.

But too many talented advisors are held back, struggling with volatile markets and inadequate tools.

At Financial Alliance, we empower our consultants, ensuring you can advise your clients with absolute confidence and build a thriving investment business.

At A Glance

Since 2003

Our dedicated Investment Team has been established for over two decades, providing stability and consistent, expert guidance through every market cycle.

Dedicated In-house Investment Team

Full-time investment professionals make up our dedicated in-house team, providing you with direct access to expert brainpower.

> S$1 Billion

In Assets Under Adviced (AUA), making us one of the largest and most trusted independently owned firms in the industry.

unfair advantage I

IN-HOUSE INVESTMENT TEAM

You are backed by a dedicated full-time investment professionals. Led by Victor Wong and Sani Hamid, this team includes CFA charterholders, quantitative specialists, and portfolio managers with experience at top-tier institutions like GIC, Credit Suisse, Barclays, and DBS Asset Management.

Victor Wong

CFA, M.Sc (Financial Engineering)

Director (Product & Investment Advisory)

Victor has more than 20 years of experience in the financial sector, covering Central Banking, Corporate Banking and Fund Management. During his 8-year stint in the Fund Management industry, Victor has worked in DBS Asset Management and Deutsche Asset Management managing Bond Fund. Prior to joining Financial Alliance, he was managing monies for high net worth clients with ING Asia Private Bank.

Sani Hamid

CFP, M.Sc (Applied Economics)

Director (Economy & Market Strategy)

Sani has more than 20 years of working experience in the financial markets, having worked for companies such as S&P MMS where he led a team of analysts covering Emerging Asian economies; BNP Paribas Peregrine as a Senior Economist; and S&P Ratings as a Sovereign Analyst overseeing the ratings of countries such as Indonesia, India, Malaysia and Singapore.

Lim Eng Guan

M.Sc (Financial Engineering)

Portfolio Manager

Eng Guan is a quantitative investment practitioner with more than 17 years of experience. He has worked as an investment professional in GIC, structured trade reviewer at Credit Suisse, valuation controller at Barclays Capital, and portfolio manager of a multi-strategy fund at LiquidValue Asset Management. He also co-founded AllQuant, an entity focussed on financial markets education.

Patrick Ling Lee-Ee

M.Sc (Wealth Management)

Portfolio Manager

Patrick has more than 17 years of experience in investing. He has worked as an investment professional at UBS wealth management, equity derivative sales at Calyon, product controller at Credit Suisse, and portfolio manager of a multi-strategy fund at LiquidValue Asset Management. He also co-founded AllQuant, an entity focused on financial markets education.

How You Are Supported:

Stop spending your nights and weekends on research. Our team does the heavy lifting, so you can focus on your clients.

Dominate Every Client Meeting

Walk in armed with our Monthly Market Performance Reports covering both macro and micro-level analysis.

Get Real-Time Alerts

Join our exclusive WhatsApp Investment Group Chat for critical market updates and ad-hoc insights delivered straight to your phone, allowing you to act faster than the competition.

Advise with Confidence

Leverage our detailed Portfolio Commentary and FA Top Funds Recommendations to build smarter, more effective portfolios.

Master Fixed Income

Stay ahead of the curve with our in-depth Quarterly Fixed Income Report.

Navigate a World of Choice

Effortlessly understand the entire landscape with our comprehensive Comparison of All Managed Accounts Services and clear Guidelines for Fees and Charges.

unfair advantage II

PROPRIETARY TOOLS

Harverz—our exclusive, in-house analytical engine, was built with one purpose: to give you the data and tools needed to build superior client portfolios quickly and justify your recommendations with undeniable proof.

How to use Harverz in your advisory practice

Move beyond basic product comparisons and advise your clients with a deeper level of insight. Harverz empowers you with a suite of powerful analytical functions, allowing you to:

Validate Your Strategies: Use Backtesting to see how your portfolio ideas would have performed historically and run Stress tests to model performance under pressure, giving both you and your clients unshakable confidence.

Find Top Performers: Utilize Returns ranking, Rolling returns, and Risk/Reward analysis to pinpoint the best solutions for any client objective.

Uncover Hidden Risks: Conduct professional Correlation analysis and Seasonality analysis to understand how different assets work together, ensuring your portfolios are truly diversified.

Construct Superior Portfolios with Speed

All this power culminates in the most crucial step: building a better portfolio. Harverz empowers you to construct data-driven Target Allocation Portfolios (TAP) with speed and precision, so you can spend less time on administrative work and more time closing deals.

A tool this powerful is a true game-changer. At the seminar, you will get an exclusive look at how Harverz works and how it can transform your advisory business.

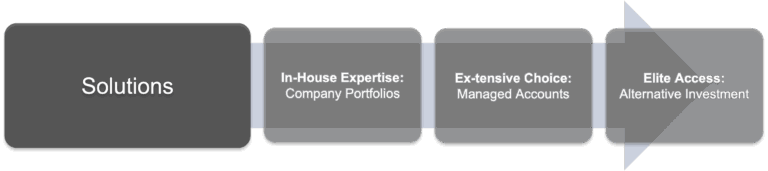

unfair advantage III

UNRIVALLED RANGE OF SOLUTIONS

Go beyond a limited product shelf with a platform that gives you true freedom of choice.

In-House & Managed Portfolios: Immediately access a full suite of strategies, including our own Core, Dividend, Thematic, and Quant portfolios, alongside a massive menu of Managed Accounts.

Elite HNW Access: Confidently serve high-net-worth clients with access to Private Markets and sophisticated Structured Products.

True Open Architecture: Utilize our 7+ platform partners to always find the perfect, best-fit solution for your clients.

Your Advantage Starts with the Right Support.

Date: 20 November 2025 (Thursday)

Time: 7:00 PM – 9:00 PM

(Light refreshment will be served from 6:00pm)

Sani Hamid

Director, Wealth Management

(Economy & Market Strategy)

Sani has more than 20 years of working experience in the financial markets, having worked for companies such as S&P MMS where he led a team of analysts covering Emerging Asian economies; BNP Paribas Peregrine as a Senior Economist; and S&P Ratings as a Sovereign Analyst overseeing the ratings of countries such as Indonesia, India, Malaysia and Singapore.

Kenny Loh

Wealth Advisory Director

Kenny Loh, a former engineer with an M.Sc. from NUS, transitioned his technical expertise into a thriving career as a Wealth Advisory Director at Financial Alliance.

With over 9 years at Financial Alliance and S$20 million in assets under advisement, Kenny is a Certified Financial Planner, Associate Estate Planner Practitioner, and Certified Estate Planner.

He understands the challenges and rewards of a career change, and he’s passionate about helping others achieve their full potential.

Hear what our consultants say

“With the support from Financial Alliance, I am able to expand my service and my Asset Under Advice (AUA) increased from $25m to $75m in just 5 years.”

Wilfred Ling, Wealth Advisory Director

“At FAPL, the support is on another level. I get clear, actionable market outlooks and investment strategies handed to me by an in-house team. The tools and training are designed to give you a real edge.”

Kenny Loh, Wealth Advisory Director

“In a volatile market, managing client emotions is everything. Sani and Victor’s team gives you the tools and insights to turn client anxiety into confidence. Their support has been instrumental in the steady growth of my AUA, especially when times are tough.”

Valerie Eng, Senior Financial Advisory Manager

Still Curious?

Access to this level of in-house support is extremely limited in the industry. This is your opportunity to see it firsthand. Seats are limited to ensure a valuable, interactive session.

Date: 20 November 2025 (Thursday)

Time: 7:00 PM – 9:00 PM

(Light refreshment will be served from 6:00pm)